Therefore, factoring invoices provides fast funding that helps you settle pressing bills and pass the responsibility of chasing payments to the factoring company. Since truckers' salaries, fuel, and maintenance costs need settling sooner than the advertised 45 days, a trucking company can fall into cash flow issues. Although the industry average for paying carriers is between 30-45 days, the reality is most clients pay late. Would it not be better to chase payments rather than share profits with other people? That sort of thinking ignores the reality of the trucking industry.Īccording to the American Transportation Research Institute 2020 report, the operational cost per mile of running a truck is $1.65 on average.

Why a company would need freight factoring servicesĪny business owner would question the wisdom of selling their invoice for a lower fee instead of waiting for the customer to pay.

To others, the cost implication is a deal-breaker. That’s why most settled on freight factoring services.įor some freight businesses, the quick payments can save their business as it helps settle freight bills without incurring debt. In the past, trucking companies relied on traditional funding options such as a credit card or business loan, but they offered punitive interest rates and unfriendly termination fees that chewed through profits. The transporter will sell their outstanding invoices or bills of lading to truck factoring companies in exchange for ready cash. Since delayed payments will cause cash flow issues, freight factoring steps in to seal the financial gaps. For most, the waiting period is usually 30, 60, or 90 days. If anything, the industry standard between delivery and payments to trucking companies is 40 days.Įxpectedly, most freight companies will offer a short-term grace period before requiring their customers to pay for the transportation services.

Truck invoice factoring full#

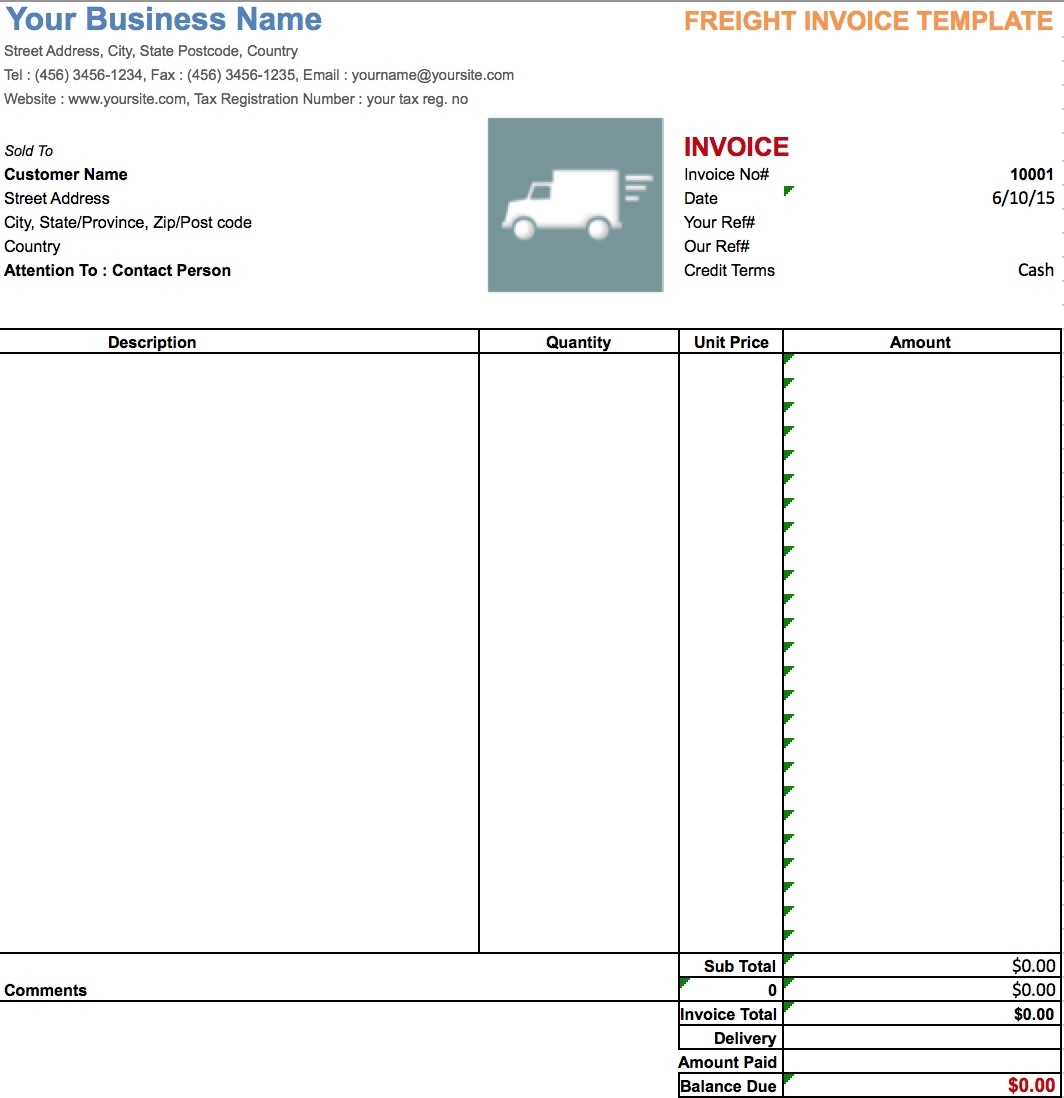

Just like other industries where large sums of money are involved, it’s not realistic for freight companies to expect full payment upon delivery. What is freight factoring?įreight factoring is a flexible source of funding that allows a trucking business or owner-operators to make deliveries and issue invoices and instead of enduring the typical payments delay, they can sell that invoice to a factoring company for a ready cash amount that’s slightly less than the invoice amount. If you are looking for a way to bridge cash flow shortages, here’s all you need to know about factoring for trucking companies.

Even though you will be providing your transportation service consistently, your customers may not pay you every time you make a delivery, causing cash shortages. Some of these expenses can occur abruptly, such as a vehicle breakdown. On average, fuel costs will set back a mid-sized trucking business $50,000-$70,000 yearly, while tire replacement pricing is between $1,000 and $4,000 per truck. If you run a trucking company, you understand how fuel, insurance, repairs, and maintenance costs can eat through your revenue, negatively affecting cash flow.

0 kommentar(er)

0 kommentar(er)